solution for fiscalization

logifis is a solution for the fiscalization of invoices. logical has been certified to provide fiscalization as a developer and support provider. Fiscalization is offered through our software that is integrated with the fiscalization system, and as an added solution to businesses who use their own software for invoices, that aren’t certified for fiscalization.

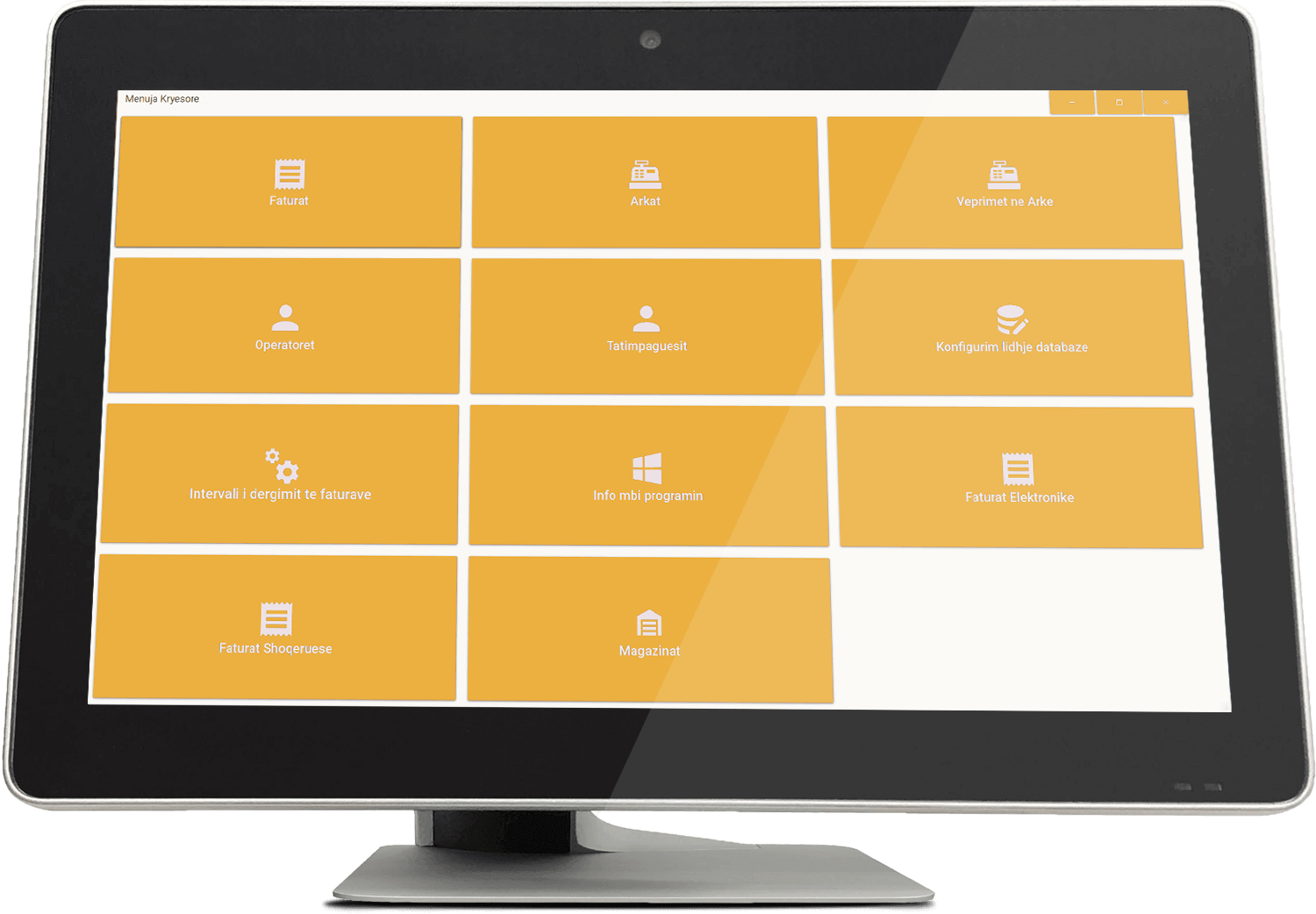

logical’s solutions for fiscalization

logical has been certified as an operator for handling the fiscalization process both as a developer and as a support provider. logical’s desktop and mobile apps for retail, distribution, logistics and hospitality are integrated with logifis, our fiscalization solution.

fiscalization for third parties

logical provides the fiscalization service for businesses that use their own software for filling out invoices, that have not been certified for fiscalization. Our solution is integrated with their software to provide the communication between their business and the tax platform.

what is fiscalization?

Fiscalization is the process in which a set of measures are taken to diminish tax evasion during cash and/or non-cash transactions. During the fiscalization process, all invoices (transactions) are reported in real time to the Tax Authority.

who are the subjects involved?

(2) banks and financial and non-banking institutions

(3) all taxpayers who give out invoices for selling products or services.

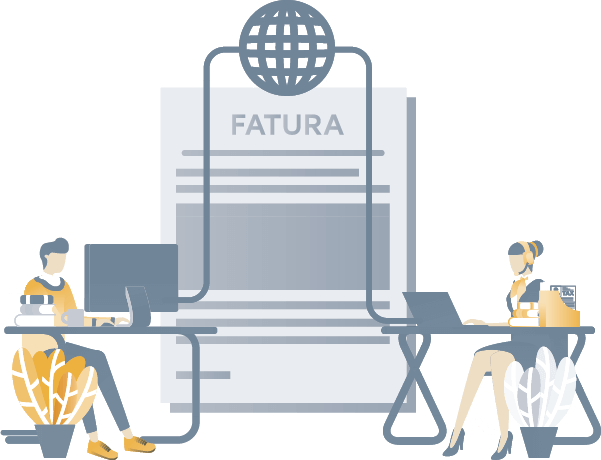

how does fiscalization work?

The taxpayer sends a message to the server of the Tax Authority through the software solution where data is sent in XML format for the transaction (the invoice that has been given out).

The Tax Authority sends a confirmation that the invoice has been received to the taxpayer and issues a unique identifying invoice number (UIIN) to the invoice. The taxpayer then gives the invoice with the UIIN to the customer buying products/services.

unique identifying invoice number

The UIIN is a unique number issued to every invoice to establish the connection between the invoice and its issuer. The UIIN serves as the main datum of the invoice that is used to identify and register this invoice in purchasing and selling books.

The Information System of the Tax Authority generates the UIIN after the invoice verification process has finished successfully. Afterwards it sends the UIIN to the taxpayer as a confirmation that the invoicing data has been properly accepted.

how to confirm invoice fiscalization?

The individual who receives an invoice can check if the invoice has been fiscalized within 60 days through the central tax platform, a special app that can scan the QR code in the invoice, and the Tax Authority’s office.

If the buyer is a taxable individual, they can verify if the invoice has been fiscalized or not through the central invoice platform, as the invoice should be registered in their purchasing book.

fiscal device certificate

The digital certificate is connected in a unique way to the business as an entity. Therefore, the same digital certificate can be used for all fiscal devices of the business.

criteria for the invoice printer

The printer used by businesses to print out invoices should be able to print out a QR code and all obligatory information as it’s specified by the fiscalization legislation.

when should you print the invoice?

Print the invoice for every cash transaction except for:

(1) invoices for electronic services

(2) when the goods or services provided have been ordered or purchased through a smartphone application or an online store.

changes to the invoice

The invoice cannot be changed once it has been printed in accordance with the value-added tax law and the fiscalization law. But you can add clarifications by issuing a correcting invoice.

saving invoices

All invoices should not only be sent to the Tax Authority, but they should also be kept by the taxpayer in a digital format, in accordance with the current operating tax legislation. Invoices can also be saved in the cloud.

deadline for uploading invoices

Invoices must be uploaded within 48 hours when there’s internet connection problems and they’re not uploaded in real time. If the fiscal device is broken, it must be repaired/replaced within 5 days.